*Fiscal policy=Gov’t tax and spending

*As opposed to previous lectures this will focus on tools instead of goals

-

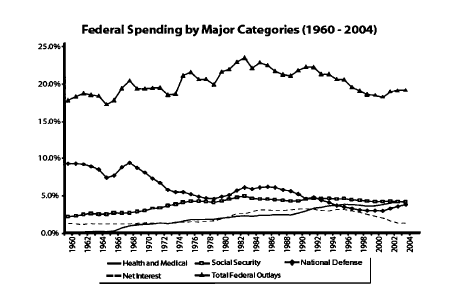

Fiscal policy is important because of the sheer size of government spending, being 1/5 of all US spending and 1/16 of world spending. Although it is huge and changes every year there are some long-term patterns

- Of Gov’t spending in 2005: 22% was health(mainly Medicare and Medicaid), 21% social security, 19% defense, 7% interest. These compile the bulk of Gov’t spending and these five areas comprise about 70% of the budget. 31% all the rest(agriculture, anti-poverty, international spending, communication, etc)

- Elderly spending, mainly Medicare Medicaid and social security, comprises roughly half of all Gov’t spending and over the decades has grown

- Defense spending is about 4% of GDP and has steadily gone down over time from roughly 10% in the 50’s to about 3-4% as of 2005

-

Most arguments about Gov’t spending is over rather small, comparatively, amounts(e.g. earmarks)

-

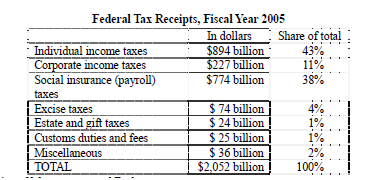

Federal taxes are very complex but again patterns have held over time

-

95% of federal taxes are comprised of income taxes, corporate income taxes, payroll taxes(social security taxes and Medicare, and excise taxes of gasoline, cigarettes and alcohol.

- In 2005 the Gov’t collected $2.05T in revenues: 43% individual income taxes, 38% social security taxes, 11% corporate income taxes, 4% excise, 2% misc., 1% customs duties and fees and 1%estate taxes

- Though most people tend to think of income taxes as the main tax, as shown above, payroll taxes are almost equal with most of the income taxes paid by the wealthy and most payroll taxes funded by everyone else

- Most people pay more in payroll taxes than income taxes

-

Federal taxes collected have remained between roughly 17-19% of GDP since 1960, but in the mid to late 90’s crept higher up to 20.1% of GDP, the highest since WWII,

- Which is why Bush and Gore both campaigned in 2000 to lower taxes

- And by 2003 taxes collected fell sharply to 16.4% which was the lowest since the 1950’s

- Providing a huge swing from just a few year s before, resulting, mostly, from the “Bush tax cuts” which lowered income taxes.

-

-

Usually people want to leave social security out of fiscal discussions since “it has its own trust”

- Amounting to arguing that since the money is in my left pocket instead of my right that it does not count

- But it involves a contribution under law, which is a tax and involves payouts from the government which is spending

-

State and local budgets are left out of the discussion, though they are quite massive themselves being approximately 14% of GDP, because states require balanced budgets

- State and local spending focuses on, among other things; education, infrastructure and criminal justice. Education, the main recipient of s/l spending saw $600B in funds collectively, more than any one area of the federal budget

- The areas which s/l governments control are areas which need to be customized to its local citizenry so a person may choose the type of place he lives in. ranging from a high tax high service area, to a low tax low service area

- National politicians often speak of state and local issues as if they have any control over them. If one wants to fix infrastructure or reform k-12 education then he should run for governor

-

As for the federal Gov’t, in any one year spending and taxes do not need to match. Somehow, however, the Gov’t must raise money, this is done through selling bonds(issuing a note with a promise to pay, with interest, at a later date)

- If a Gov’t spends more than it takes then it is a deficit, if it takes more than it spends then it is a surplus

- Over the past half century the US has mostly run budget deficits but towards the end of the 90’s and barely into the centuries turn we ran surpluses. This can be explained more from a tax collected standpoint as mentioned above than from a change in spending

-

Fiscal policy of taxing and spending goes back to the four pillars of macro-economics

-

Growth-Government borrowing and spending is part of the national identity and when a Gov’t does borrow it becomes the elephant in the bathroom soaking up available capital

- Which means less money for private investment

- Plus we become more dependent on foreign capital

- If there is more saving and less borrowing we can spend money on the things that have a long-term benefit

- Unemployment-redesigning tax burdens on employers or spending subsidies for the unemployed might reduce the natural rate of unemployment. In a recession, spending more or taxing less could stimulate aggregate demand and reduce cyclical unemployment

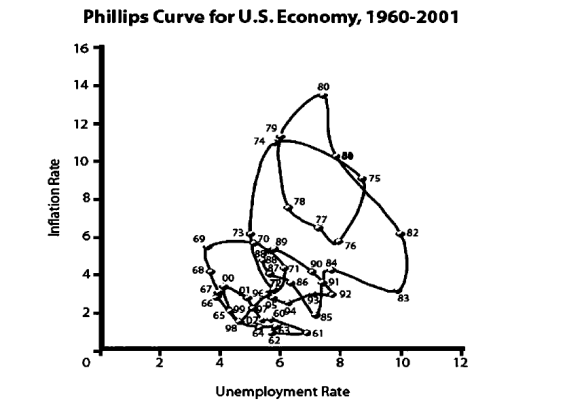

- Inflation-could be fought by spending cuts or tax increases

-

Balance of trade- Gov’t borrowing increases equals more foreign funds (i.e. a higher trade deficit)

-